Asian Stock Markets Follow US downward Trend amid Inflation Concerns

- 14 February 2024 2:01 AM

Asian equities have mirrored the falling trend seen on Wall Street, prompted by unexpected US inflation data. Meanwhile, the Japanese Yen fell past 150 per dollar, provoking a response from the country's top currency official Masato Kanda who cautioned that rapid changes in foreign-exchange rates could prompt official intervention if required. Stocks in South Korea, Japan, Australia, and Chinese-Hong Kong showed a decline as Hong Kong market reopened post the Lunar New Year holiday.

Keiichi Iguchi, a senior strategist at Resona Holdings Inc., suggested the market's anxiety stems from the potential for verbal intervention by the Japanese authorities. "Some nervousness will prevail among investors due to intervention concerns," said Iguchi.

Yields on treasury bonds spiked after a significant increase on Tuesday, subsequently reducing bets on an early interest rate cut by the US. The 10-year government bond in Japan reached a peak not seen since December, and the dollar traded close to its highest in three months. Australian and New Zealand debt also advanced.

The US-traded Golden Dragon Index of Chinese firms posted its most considerable decline in a month on Tuesday, falling by 2.7%. Notably, swap traders reduced their expectations for a Fed rate cut before July while the stock market's VIX, or "fear gauge," bolted up for the first time since October.

Chris Zaccarelli at Independent Advisor Alliance suggested the recent CPI report had caught many investors off guard. "Many investors were expecting the Fed to begin cutting rates and were spending a lot of time arguing that the Fed was taking too long to get started," said Zaccarelli.

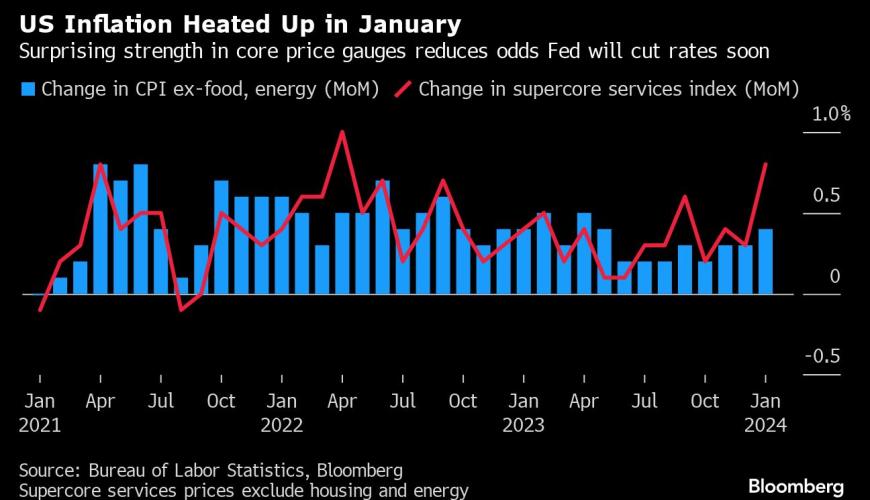

The expectations for rate cuts this year, fueled by recent downward trends in price pressure, received a setback from the CPI data. The figures also put weight behind the wait-and-see approach being emphasized by Fed speakers, including Jerome Powell.

The odds of a May rate cut, according to swap contracts tied to Fed policy meetings, dropped to around 32% from the predicted 64% pre-inflation data, with less than 90 basis points anticipated within this year. "The Fed has now locked the door and lost the key," said Greg Wilensky at Janus Henderson Investors, referring to the increasing unlikely chance of a rate cut in March.

In other markets, gold dipped below $2,000 per ounce for the first time since December due to diminishing hopes of an early US rate cut, while Bitcoin remained near the $50,000 threshold. The price of oil also decreased.

Looking forward, this week will witness a series of key financial events, including testifying from BOE Governor Andrew Bailey to the House of Lord's economic affairs panel, speeches from Fed Vice Chair for Supervision Michael Barr and Chicago Fed President Austan Goolsbee, and reports on Japan GDP and US industrial production. The week will conclude with a speech from ECB chief economist Philip Lane and a report on US housing starts.