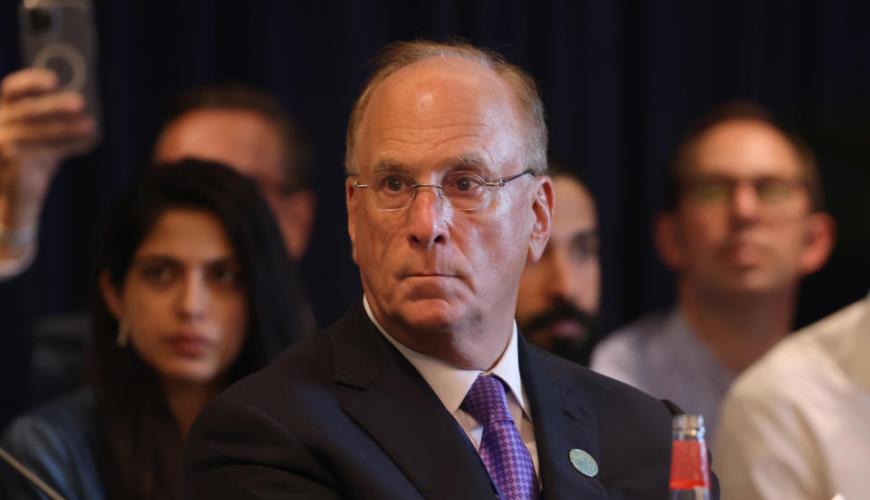

Larry Fink lashes out at BlackRock's political critics: They 'continuously lie'

BlackRock (BLK) CEO Larry Fink lashed out at political critics of the world's largest money manager in combative new comments Friday, saying they "continuously lie."

The remarks came as his firm continues to face heat from hot-button political fights across the country.

"We have done a better job now of telling our story so that people can make decisions based on facts, not on lies and not on misinformation or politicization by others," Fink said during a first quarter earnings call.

"Unfortunately, there's still others out there ... who continuously lie about these issues," he added.

Fink didn't name any US politicians directly but the comments appear to be an unmistakable reference to continued attacks from politicians on the Republican side of the aisle both in Washington and in conservative states like Texas.

Republicans have continued to try and make Fink and his firm into the preeminent example of what they charge is "woke investing" as the 2024 election season continues to heat up.

Fink also says the attacks aren't working, pointing to an increase in US investments in his company. He says there has been $1.9 trillion in total net inflows from US investors into BlackRock over the last five years and nearly $300 billion in new US investor money that appeared on the company's books just in the last year.

"I do believe that with the vast majority of our clients, our long-term fiduciary approach and performance are resonating," says Fink.

The new comments came as the world's largest asset manager reported overall results that included new record levels of assets under management, with the company now managing $10.5 trillion in investor money around the world.

The company's stock opened down as trading began Friday, falling more than 1%.

BlackRock's stock is also down for 2024 as a whole, while the S&P 500 has risen around 8% in recent months, according to Yahoo Finance data.

The committee recently subpoenaed BlackRock and other asset managers as it seeks information on what it calls "collusive agreements to promote and adopt left-wing environmental, social, and governance (ESG) goals."

Fink has also backed away from using the politically contentious acronym, vowing last year not to say ESG and arguing it had become weaponized.

Friday's commentary also came after a recent dustup between BlackRock and a Texas government fund that announced plans to withdraw $8.5 billion as the chairman of the Texas State Board of Education charged that BlackRock policy was to "boycott energy companies."

That charge came after Fink had made inroads with Texas's conservative government on infrastructure issues, even receiving praise from Texas Lieutenant Governor Dan Patrick earlier this year.

In his annual letter last month, Fink pushed back on the boycott charges, pointing out his firm "has never supported divesting from traditional energy firms" and currently has more than $300 billion invested in such companies.

Fink has also continued to urge investors to stay focused on an ongoing global transition in energy, with a specific focus on infrastructure projects that will fuel new traditional and renewable energy sources in the years ahead.

The issue fueled BlackRock's recent $12.5 billion bet to buy private equity firm Global Infrastructure Partners as it anticipates growing demand for new energy, transportation, and digital infrastructure projects in the coming years.

Fink told investors Friday he sees "unprecedented need for new infrastructure" in the years ahead and is aiming for the Global Infrastructure Partners deal to close later this year.

The company's quarterly earnings call Friday morning also touched on an array of other topics from new offerings in the retirement space to the recent introduction of a bitcoin ETF. Fink also drew attention to investors who are still holding cash on the sidelines in response to what he describes as "fear and uncertainty" emanating from US and global politics.

"We started 2024 with great momentum and I strongly believe that there are more opportunities ahead for BlackRock, more than any other time before," Fink said as he signed off Friday, wishing investors a good quarter.

Ben Werschkul is Washington correspondent for Yahoo Finance.