Maximizing the Southwest Companion Pass Credit Card Offer for Almost-free Flights

- 27 February 2024 2:01 AM

Southwest airlines recently rolled out a new welcome offer for its credit cards co-sponsored by Chase offering Companion Pass and 30,000 bonus points if a cardholder spends $4,000 within the first three months. This lucrative offer presents an opportunity to save significantly on travel, as I did last year booking trips using the Southwest credit card, saving over $600 on summer travel.

Southwest provides three Rapid Reward personal credit cards that offer Companion Pass as part of their welcome bonuses. I chose the Southwest Rapid Rewards® Plus Credit Card for its 2x reward offer on regular expenses such as local transit, streaming subscriptions, and internet and phone bills. The comparatively lower annual fee of $69 was an attractive factor, considering I do not always travel to destinations serviced by Southwest airlines.

When the Southwest Companion Pass offer was announced, my partner and I had just started saving for a summer trip. Our travel plan was to fly from New York City, where we are based, to Denver for a wedding, then proceed to Portland, Oregon for a few days before returning home. The timing of our trip coincided with the bonus offer period, so I applied for the card, authorizing my partner as a user.

For the subsequent weeks, all our regular spending went onto the card. Our expenses ranging from weekly groceries to dining out to subway rides, Ubers, and other miscellaneous expenditures, all contributed towards reaching the spending threshold. We also charged a part of our federal taxes to the card as it helped us reach the welcome offer requirement faster.

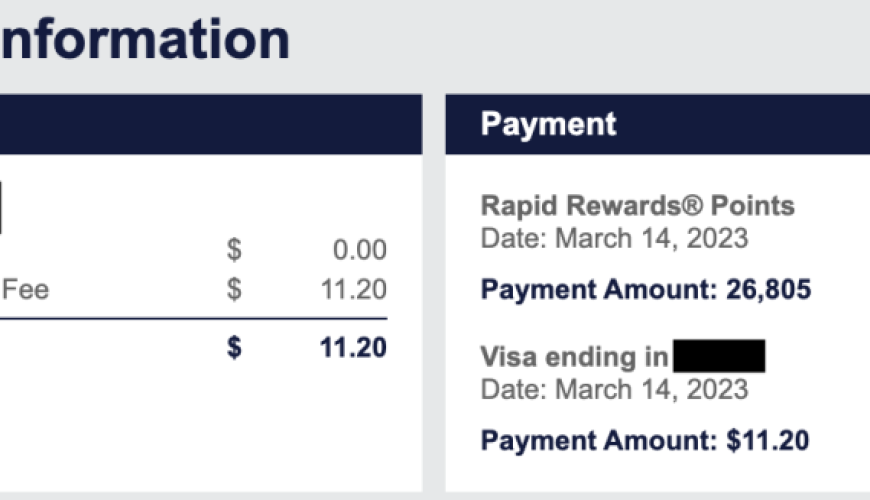

In under two months, we managed to earn the welcome bonus, meaning we had over 30,000 Southwest Rapid Rewards points and a Companion Pass ready to book our flights. With these rewards at our disposal, we booked a round trip with just 26,805 Rapid Rewards points and $11.20 each towards taxes and fees, costing us only $22.40 in total. Considering that a similar itinerary this year costs about $695.94 for two tickets, our savings, even after factoring in the $69 Rapid Rewards Plus card annual fee, amounted to $604.54.

For anyone trying to make the most out of the Southwest credit card offer, there are a few suggestions based on my experience. Firstly, ensure that you frequently travel with Southwest to maximize the use of the Companion Pass. In my case, we could only use the Companion pass once during the offer period as Southwest did not service our other travel destinations.

Secondly, if multiple people are sharing a credit card account, make sure everyone maintains a disciplined spending and payment approach. This ensures timely payments, maintains a low credit utilization ratio, and safeguards your credit history. Lastly, before signing up for a new credit card account, determine whether the spending requirement matches your budget, if not, the eventual debt could outweigh the savings from the offer.

Please note that the information provided in this article has been presented without any advertiser approval. As of publication, all financial product details, including card rates and fees, are accurate. Always check the bank’s website for the most up-to-date details as this site does not include all current offers.