Stock market today: Stocks sink, yields jump after inflation data torpedoes rate-cut hopes

Contents

- Best watch the dollar after the CPI report, too

- Delta beats Q1 earnings expectations, CEO sees 'quite healthy' travel demand

- Stocks slide at the open

- Inflation hotter than expected in March

- If companies are clamping down on spending ahead of the election ...

- Nvidia weakness persists

- Date save for crypto investing fans

- Here’s a markets stat to get your day started right

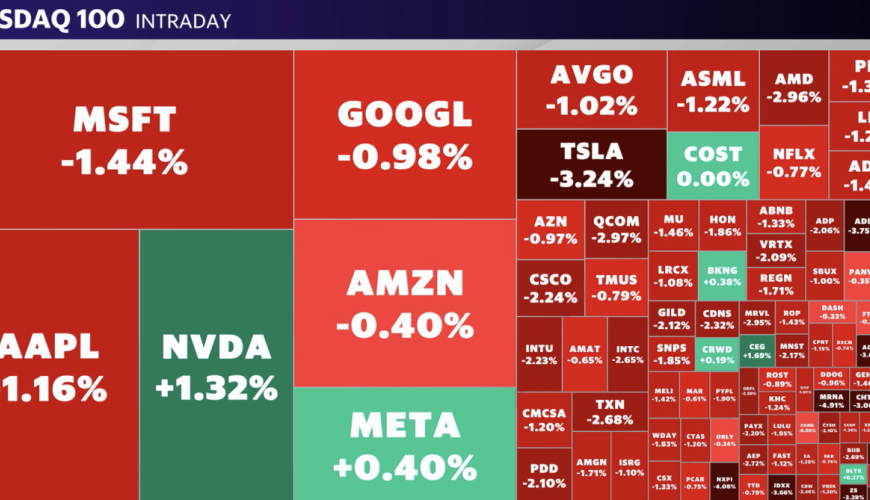

US stocks stumbled on Wednesday after a key inflation report showed an unexpected uptick in consumer prices last month.

The Dow Jones Industrial Average (^DJI) fell about 1.1%, or almost 425 points. The S&P 500 (^GSPC) dropped nearly 1%, and the tech-heavy Nasdaq Composite (^IXIC) lost almost 0.9%.

Meanwhile, bond yields soared. The 10-year Treasury yield (^TNX) gained as much as 20 basis points on Wednesday afternoon, hitting nearly 4.57%, its highest level since November.

The moves came after government data showed the Consumer Price Index (CPI) rose 0.4% over the previous month and 3.5% over the prior year in March, an unexpected acceleration from February's 3.2% annual gain in prices.

Both measures came in ahead of economist forecasts of a 0.3% month-over-month increase and a 3.4% annual increase, according to a survey by Bloomberg.

The hotter-than-expected print could prompt investors to expect fewer rate cuts from the Fed this year. Indeed, according to the CME FedWatch tool, around 80% of bets are now on the Fed holding steady at current rate levels in June. More than half of investors also expect the central bank to leave the rate unchanged through its July meeting, leaving September as the most likely spot for an initial cut from the US central bank.

Also out Wednesday, the latest minutes from the Federal Reserve's latest policy meeting showed "almost all" officials believed it would be appropriate to lower interest rates "at some point."

Meanwhile, crude oil futures erased earlier losses in afternoon trading following a report that the US and its allies believe a strike by Iran or its proxies against Israeli targets is imminent. West Texas Intermediate (CL=F) rose more than 1% back above $86 per barrel, while Brent (BZ=F) futures jumped to hover above $90 per barrel.

Shelter costs accounted for 60% of March’s overall monthly gain in core CPI, which doesn't include food and energy, according to the BLS.

Some Wall Street economists expect the shelter component of CPI to bottom out by spring or summer of next year based on how sticky the number has remained.

Read more here.

-

Brian Sozzi

Best watch the dollar after the CPI report, too

And we are dollar watching into the close of a tough day for markets.

The US dollar climbed 1% versus the euro, its biggest gain in about nine months, after traders pushed out odds of rate cuts on the back of another hot CPI print. The US dollar index is now up about 2.2% in the past month.

A potential delay in rate cuts could mean the US dollar stays stronger for “quite some time,” Rabobank FX strategy head Jane Foley told Yahoo Finance. “If you look at the US economy, it's certainly a lot more resilient than other major economies including Europe and China,” Foley explained. “Every week it seems like US data is chasing away the possibility of a spring or even a summer rate cut from the Federal Reserve, so that in itself, interest rate differentials, is favoring the dollar.”

Why this matters: A strong US dollar this spring could weigh on sales and profits of multinational companies in the second quarter and be a risk not many investors are currently pricing in. Be on the lookout for dollar commentary on earnings calls kicking off soon.

-

Josh Schafer

Delta beats Q1 earnings expectations, CEO sees 'quite healthy' travel demand

Delta Air Lines' (DAL) stock was just below the flat line amid the broader market sell-off on Wednesday. But the airliner did impress Wall Street with its earnings release before the bell.

Yahoo Finance's Brad Smith reports:

Delta Air Lines' (DAL) first quarter results soared over expectations as demand remained resilient, driven by a steady resurgence in corporate travel.

Here's how Delta performed versus consensus estimates compiled by Bloomberg:

-

Adjusted net income: $288 million vs. $235 million expected

-

Adjusted earnings per share: $0.45 vs. $0.36 expected

-

Revenue: $12.6 billion vs. $12.5 billion expected

"We have seen some real strong demand," Delta Air Lines CEO Ed Bastian told Yahoo Finance. "That momentum has continued internationally. It's continued domestically. ... Year to date, we've seen the 11 highest sales days in our company's history. That's a strong predictor that the spring and summer season is going to be quite healthy on the travel side.”

TSA passenger throughput in 2024 has been pacing ahead of last year's travel figures, and that's after air travel fully bounced back above pre-pandemic levels in 2023.

“We continue to see the strength of the transatlantic demand for the spring and summer continue, which is great,” Bastian said. “We're flying even higher level of capacity this summer than last, and we expect our overall pricing levels are going to remain largely the same.”

Ryan Sweet, chief US economist at Oxford Economics, said the hotter data may push more policymakers "into the two rate-cut camp."

"The Fed has a bias toward cutting interest rates this year, but the strength of the labor market and recent gains in inflation are giving the central bank the wiggle room to be patient," Sweet said. "If the Fed does not cut interest rates in June, then the window could be closed until September because there is little data released between the June and July meetings that could alter the Fed’s calculus."

"The odds are rising that the Fed cuts rates less than 75 basis points this year," he predicted.

But Greg Daco, chief economist at EY, cautioned investors to be patient: "I think we have to be very careful with this idea that it’s a play-by-play process."

In an interview with Yahoo Finance, he noted that "these types of readings do still point to disinflationary pressures. It’s still moving in the right direction, and it will take time."

Following the data's release, markets were pricing in an 80% chance the Federal Reserve holds rates steady at its June meeting, according to data from the CME FedWatch Tool. That's up from a roughly 40% chance the day prior.

More than half of investors are also betting the central bank to hold steady through its July meeting, with markets now largely anticipating the first cut will come in September.

Read more here.

-

-

Josh Schafer

Stocks slide at the open

US stocks opened sharply lower on Wednesday after a key inflation report showed an unexpected uptick in consumer prices last month.

The Dow Jones Industrial Average (^DJI) fell over 1%, or more than 400 points, while the S&P 500 (^GSPC) dropped about 1.2%, as did the tech-heavy Nasdaq Composite (^IXIC).

The hotter-than-expected inflation reading sent bond yields soaring and cooled investors' hopes for interest rate cuts at the beginning of the summer.

The 10-year Treasury yield (^TNX) rose as much as 14 basis points Wednesday morning, touching above 4.5% for the first time in 2024.

Subsequently, interest rate-sensitive sectors sold off, with Real Estate (XLRE) and Utilities (XLU) sinking at the open.

-

Josh Schafer

Inflation hotter than expected in March

The Consumer Price Index (CPI) rose 0.4% over the previous month and 3.5% over the prior year in March, an acceleration from February's 3.2% annual gain in prices.

Both measures came in ahead of economist forecasts of a 0.3% month-over-month increase and a 3.4% annual increase, according to data from Bloomberg.

Futures tied to the three major indexes fell about 1% on the news.

-

Brian Sozzi

If companies are clamping down on spending ahead of the election ...

... that clampdown isn't appearing in travel budgets, as seen in results out of Delta (DAL) this morning.

Delta said managed corporate sales grew 14% year over year in the first quarter. Particular strength was seen in "large" corporate accounts, which bodes well for earnings out of key Delta partner American Express (AXP) in a few weeks.

"We have seen some real strong demand," Delta Air CEO Ed Bastian told Yahoo Finance anchor Brad Smith. "That momentum has continued internationally. It's continued domestically. ... Year to date, we've seen the 11 highest sales days in our company's history. That's a strong predictor that the spring and summer season is going to be quite healthy on the travel side."

-

Brian Sozzi

Nvidia weakness persists

More folks should be talking about the weakness in shares of market leader Nvidia (NVDA).

The stock slipped below the 50-day moving average earlier this month (see chart below) and has stayed beneath that key momentum line since. Shares are off by almost 6% in April, compared to a slight decline for the S&P 500.

A sign of a rough patch ahead for markets this summer? Maybe. After all, this stock has been the leader for the bull market for well over a year. So if it's not leading, something may be off in the distance for investors.

-

Brian Sozzi

Date save for crypto investing fans

JPMorgan strategists are out this morning saying the next bitcoin halving is slated to take place on April 16.

In case you forgot, here is Yahoo Finance anchor Brad Smith explaining precisely what a bitcoin halving is and what it could mean for the crypto.

The JPMorgan team also served up a few good charts to get you thinking about the outlook for bitcoin mining outlook, with the process potentially being a catalyst for more price gains.

-

Brian Sozzi

Here’s a markets stat to get your day started right

Remember when the market was going up almost every single day in March?

That's not the case in April so far, and the losing ways are beginning to pile up.

The S&P 500 has now gone seven consecutive sessions without a new record, the strategy team at Deutsche Bank pointed out this morning. That marks the longest period without an all-time high since January, when the S&P 500 surpassed its 2022 peak.

The next streak to be broken could be the S&P 500's current run of five consecutive monthly gains dating back to November.