Tech Stocks Drive S&P 500 to Yet Another Record Close

- 25 January 2024 2:01 AM

In Wednesday's trading session, the S&P 500 Index marked its fourth consecutive record close, driven primarily by gains in tech stocks. The Nasdaq Composite experienced moderated gains to close approximately 0.4% higher, following an over 1% increase earlier in the session. This growth was spurred by robust earnings, especially from Netflix, and was supplemented by substantial gains from tech giants Microsoft and Meta.

The S&P 500 ended flat, maintaining its fresh closing high, while the Dow Jones Industrial Average encountered an approximately 0.3% fall. Noteworthy company announcements from ASML, a chip gear producer, and software manufacturer SAP sparked increased hopes for a tech-driven resurgence in the chip industry and a surge in AI technologies.

Earnings reports highlighted both triumphs and struggles within the sector. Notably, Tesla, despite facing challenging market conditions and formidable competitors in China, was a high point in the slew of corporate financial updates released on Wednesday. The EV maker's earnings fell short of predictions. In a more upbeat result, IBM disclosed a 4% revenue growth in the last quarter, spurred by a rising demand for AI.

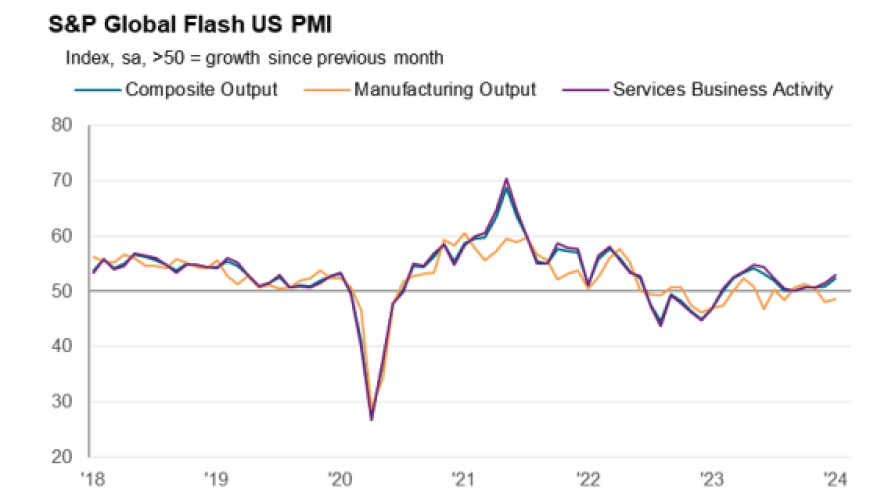

Although company earnings remain a focal point, discussions about the timing of the Federal Reserve's potential interest rate cut continue to simmer. With US manufacturing and service activity updates exhibiting strong economic output at its highest in seven months, expectations are being driven by this encouraging data. Moreover, these figures precede the upcoming release of Q4 GDP's first reading on Thursday and the favored PCE inflation estimates by the Fed on Friday.

Investor Peter Mallouk highlighted a trend often overlooked by investors - that money put into the market during its peaks has proven more profitable than funds invested at random. The perception that what goes up must eventually come down stands counter to the general direction of broad stock indexes, which have consistently trended upwards over the long term. Despite the fact that it has taken nearly two years for markets to attain new highs, according to Mallouk, markets reach a new all-time high approximately every 19 days.

In Mallouk's view, capital deployment is critical, with those remaining on the sidelines more likely to face worsened conditions than those who invest despite market highs.

In Wednesday's afternoon trading, chips maker Nvidia, streaming giant Netflix, semiconductor giant AMD, and tech behemoth Microsoft were trending stocks on the Yahoo Finance homepage. Nvidia saw a 4% increase due to an ongoing AI rally and improved industry sentiment, following ASML's announcement that orders have tripled over the quarter. Netflix’s shares also escalated substantially on news of a significant surge in Q4 subscriber additions.

Meanwhile, there were spikes in AMD and Microsoft shares. AMD gained over 5% following an upgrade by NewStreet Research's Pierre Ferragu, while Microsoft surpassed a colossal $3 trillion market cap, driven by further advancements in its cloud division and AI optimism.

Netflix's soaring shares, on the other hand, have led some to argue the stock may be overvalued despite strong Q4 results. Analysts point to potential challenges in maintaining this level of growth as Netflix’s crackdown on password sharing continues and the potential price increases could potentially lead to a spike in customer churn.